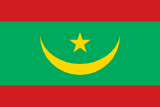

Mauritania

Regulatory Intel

Legal Framework & Compliance

Managed by the Banque Centrale de Mauritanie. The regulator is currently inviting foreign investment houses to modernize its capital markets framework.

Banking & Rails

Payment Infrastructure

A traditionally banked sector now seeing a surge in 'Mobile Money' for retail deposits, particularly in the seafood and mining hubs of Nouadhibou and Nouakchott.

Strategic Market Execution

Operations Roadmap

A phased 90-day plan covering legal entity setup, compliance auditing, and core team recruitment.

Institutional Connectivity

Direct access to regional banking networks and localized Sharia-compliant liquidity frameworks.

Regulatory Advisory

Liaising with SAMA, CMA, and ADGM authorities to secure your operational licenses efficiently.

Market Intelligence

Strategic Inquiry

A 'Ground Floor' play. As the country's gas and mining projects come online, there is a sudden surge in newly liquid professional classes seeking asset management and offshore trading.

Rising. Local banks are increasingly seeking international brokerage partnerships to offer their clients more than just standard savings accounts. This is a prime market for B2B2C white-labeling.

Yes, 4G penetration is high and the youth are following the global trend of 'Mobile-First' financial exploration. Educational content in French and Arabic is key to conversion here.

The Central Bank is generally open to internationally licensed firms that can provide high-quality training and transparent market access to Mauritanian citizens.